Beyond Banking

Wallet

Global IBAN accounts, FX, SEPA, and SWIFT — designed for modern payment flows.

Build to Perform

Modern payment experiences that just work—without the extra steps or complexity.

Speed

Low-latency processing across accounts, payments, and FX.

Modularity

Pick services that fit you, nothing more, nothing less.

Compliance

Regulatory-ready infrastructure across Europe.

Scale

From local payments to cross-border flows on one platform.

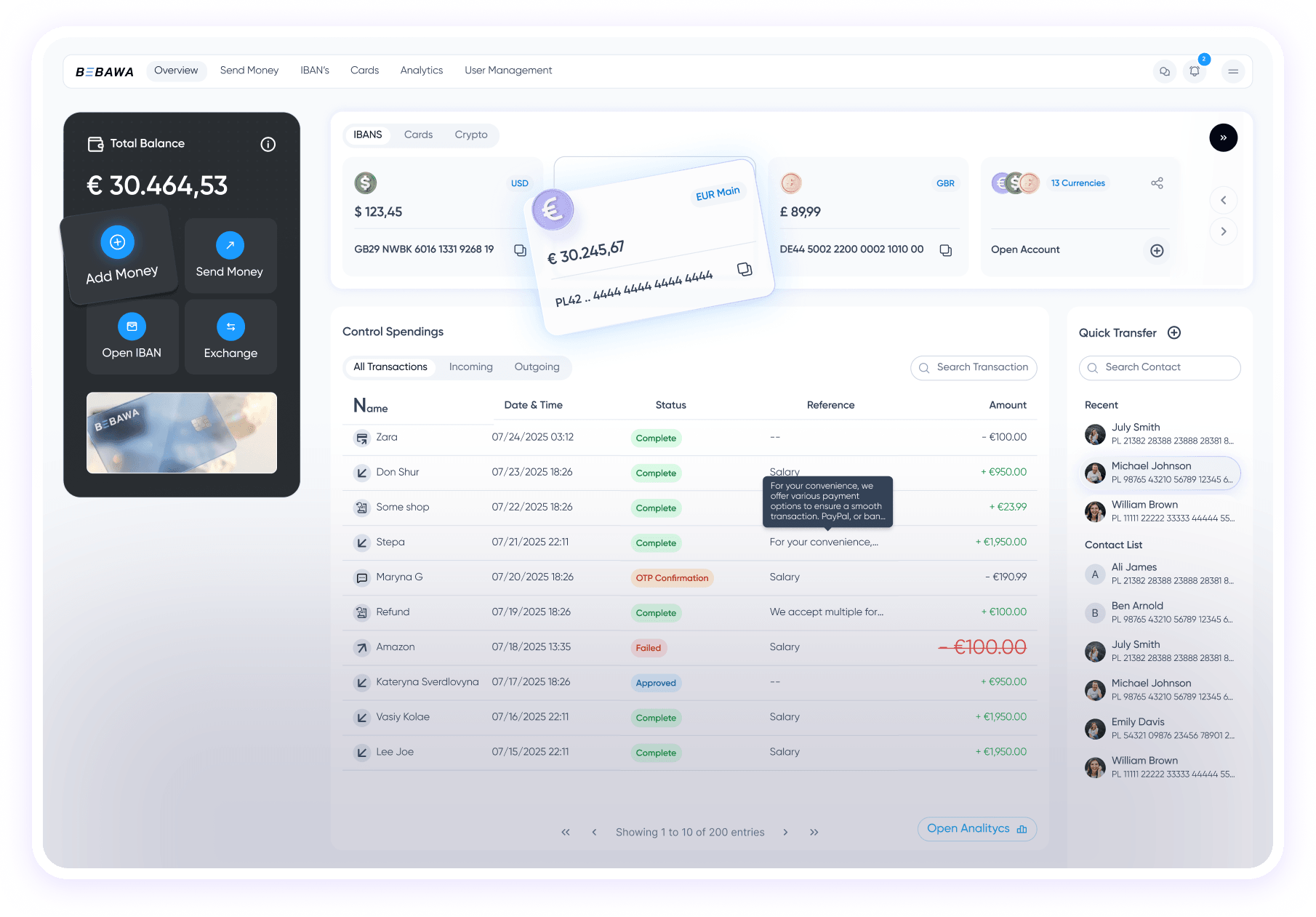

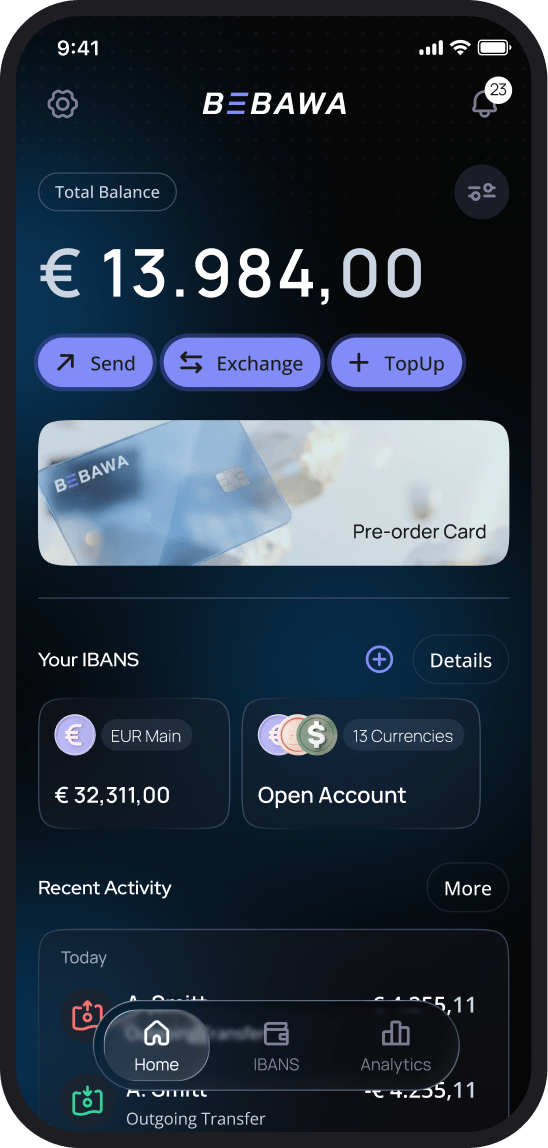

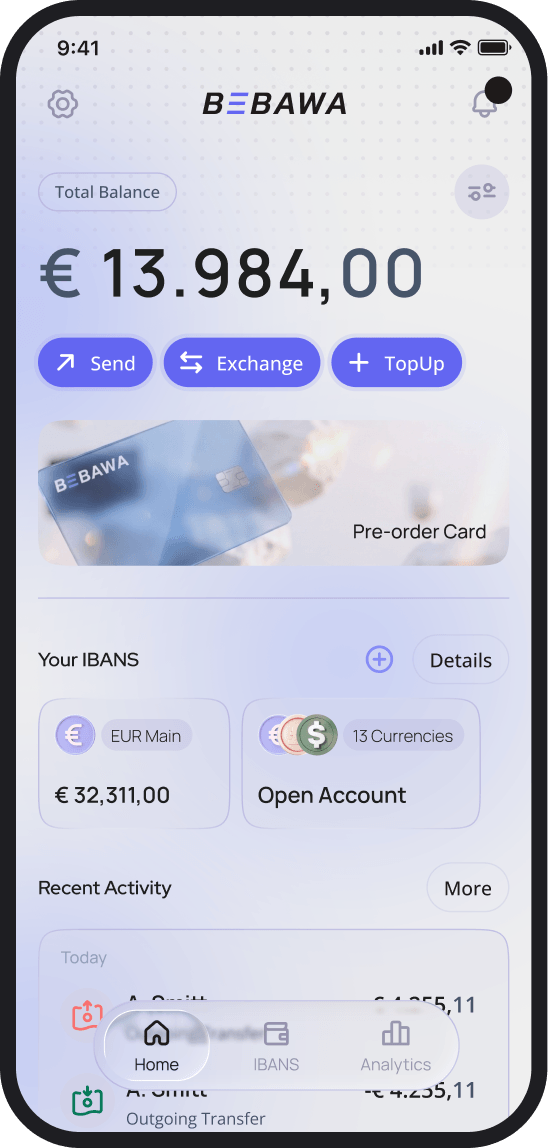

Everything you need to manage your money, without the complexity

Simple, secure tools to send, spend, and manage your money.

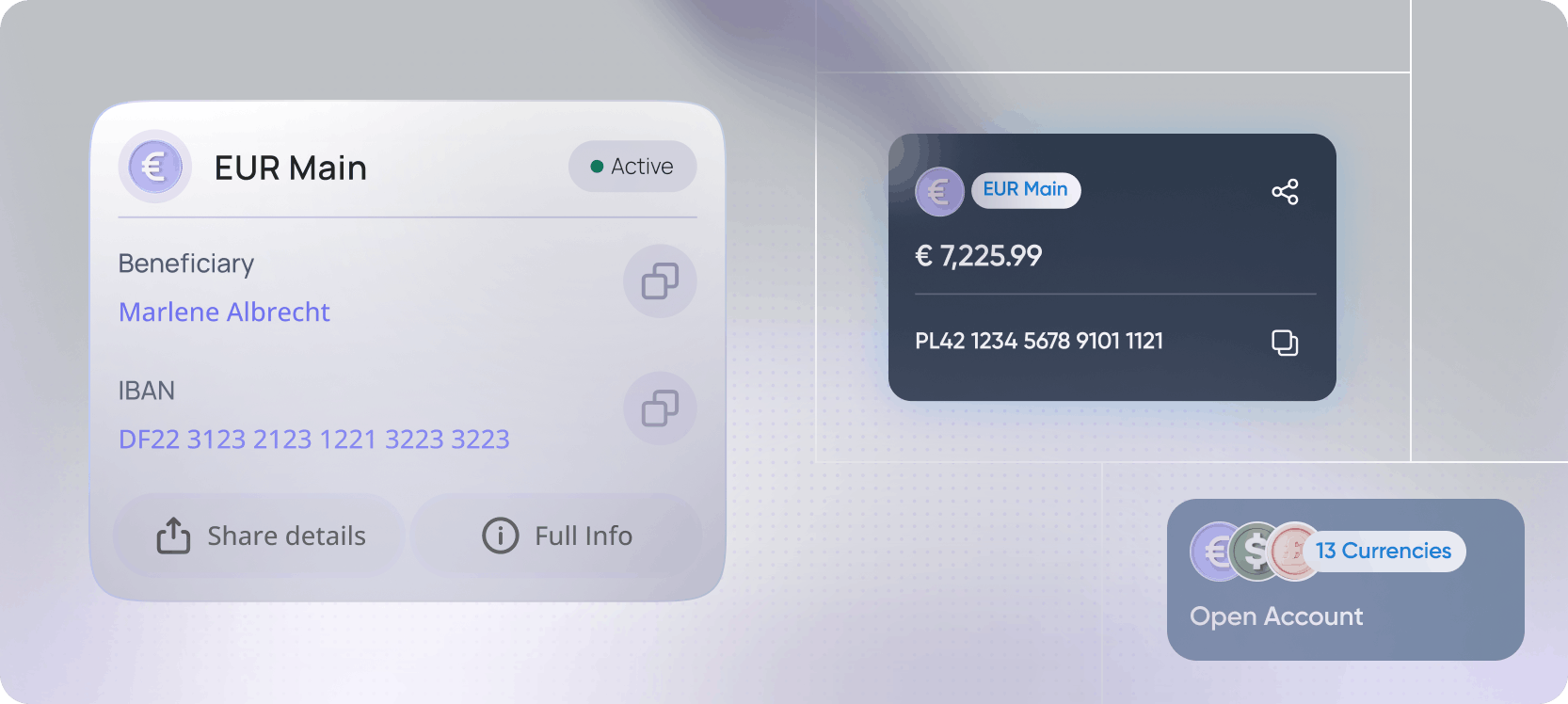

IBANs & Multi-currency accounts

Real and virtual accounts with full control over balances and permissions.

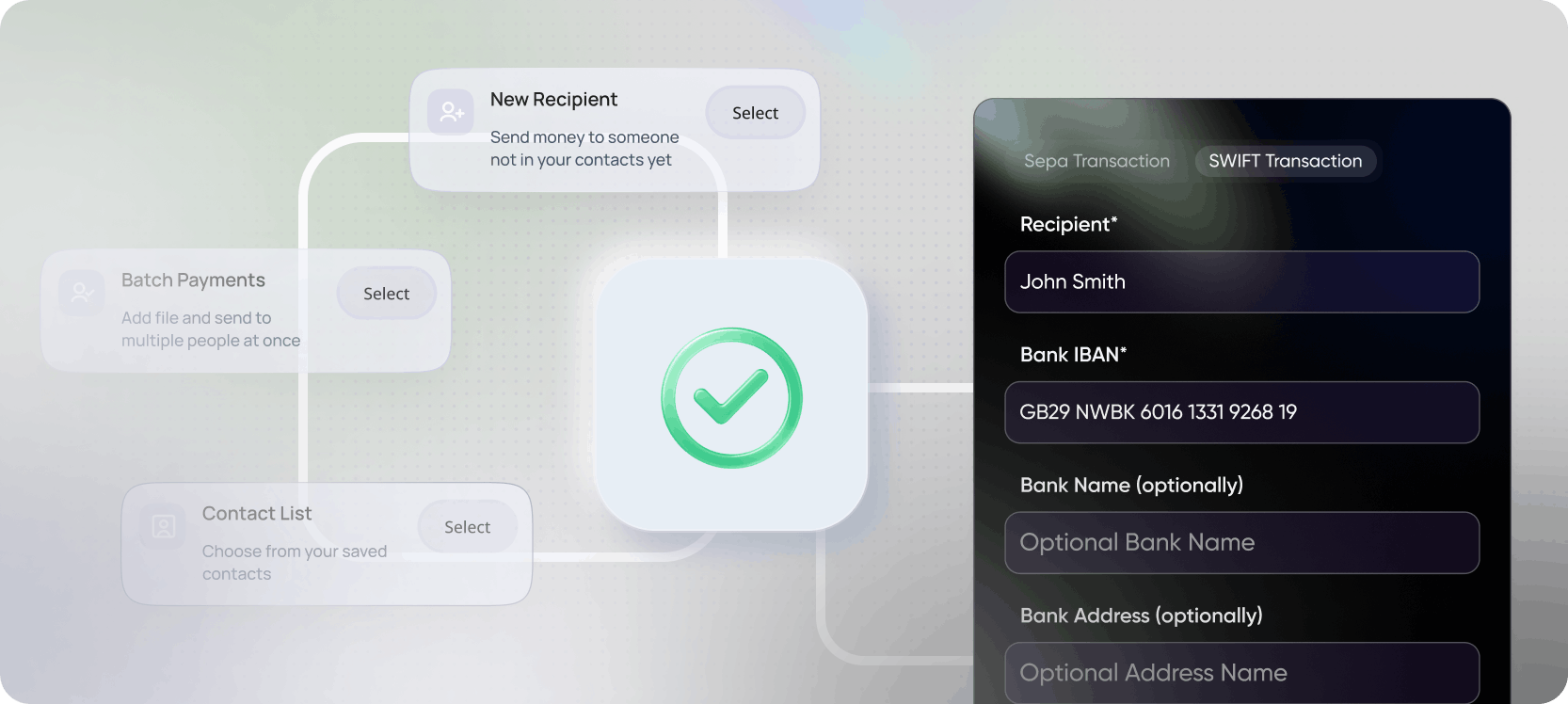

SEPA & SWIFT transfers

Local and cross-border payments, processed reliably and transparently.

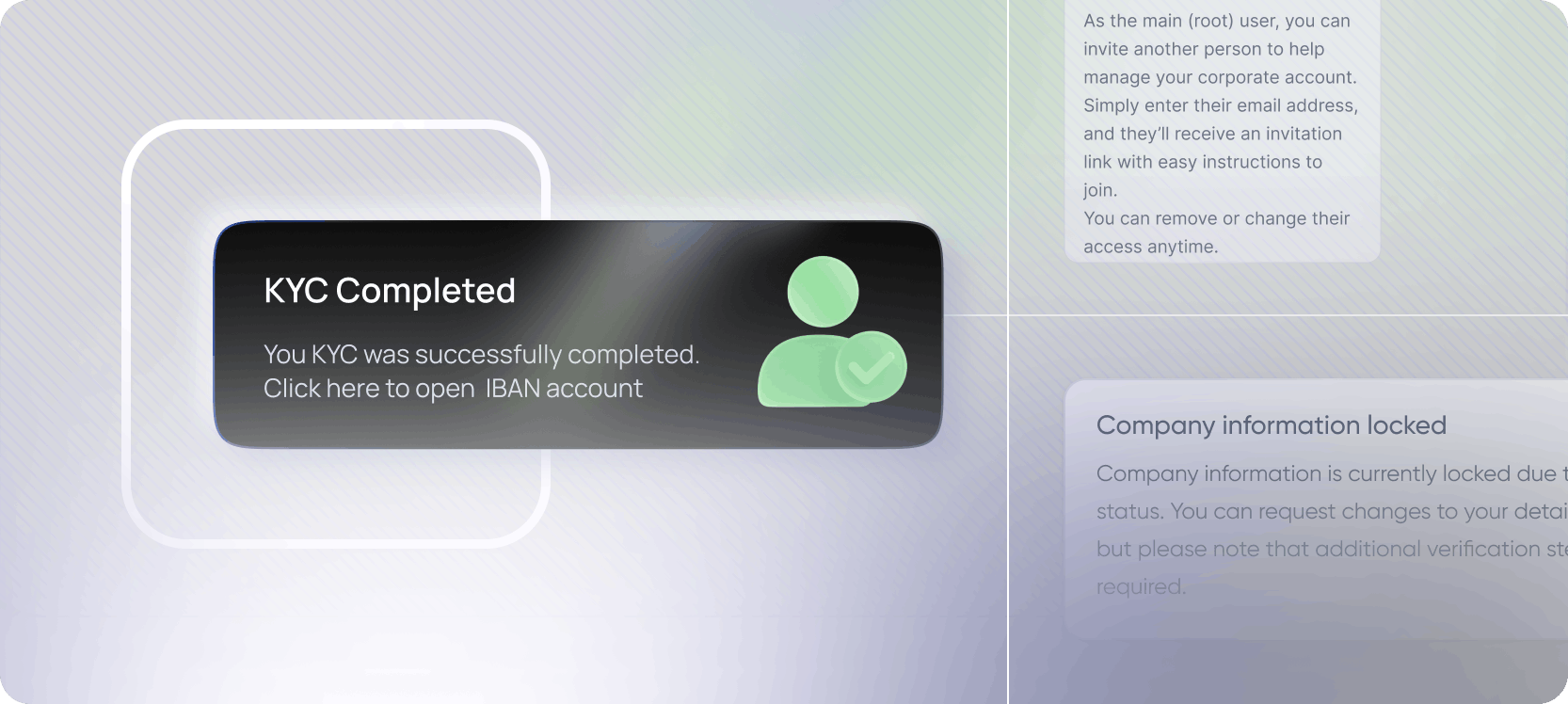

Permissions Management

Fast, seamless onboarding and intuitive user management

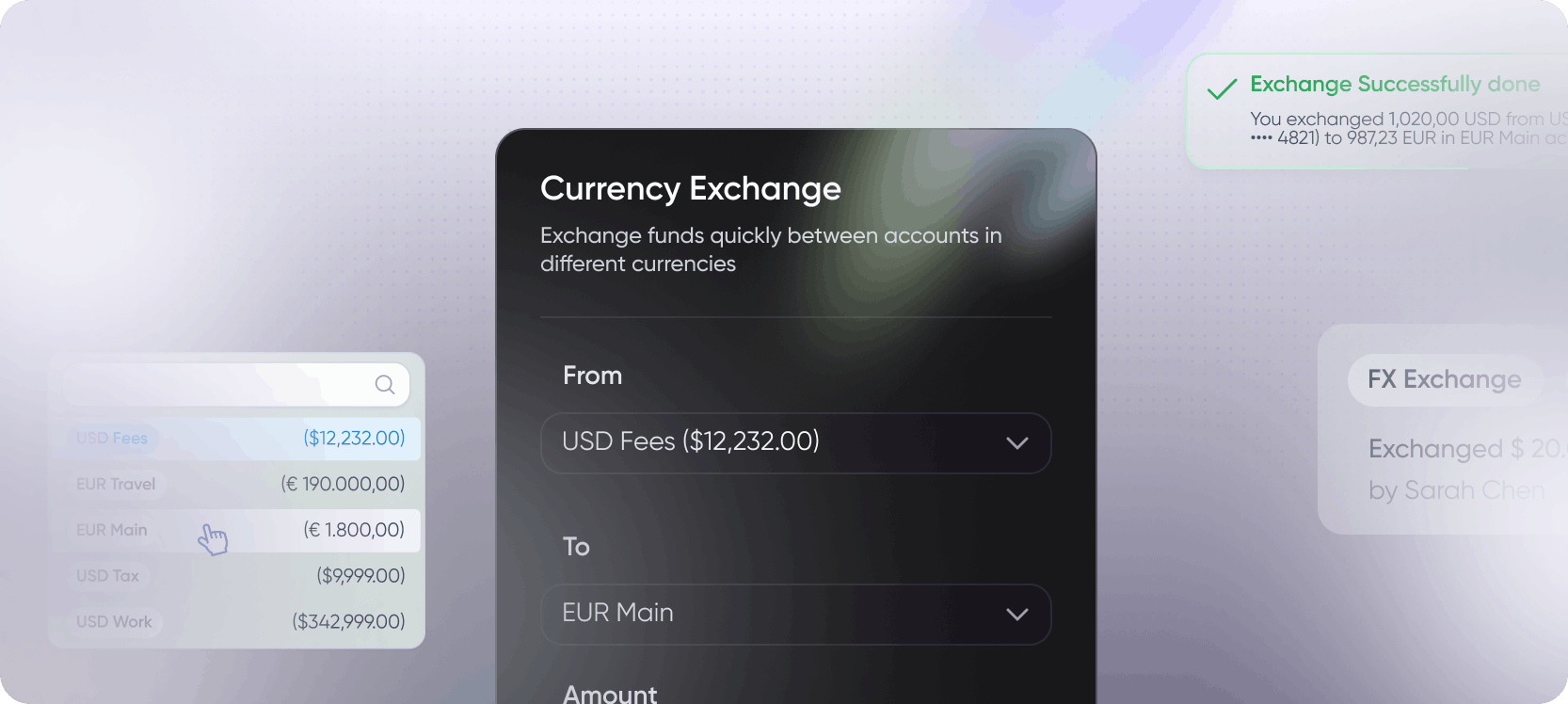

FX

Seamless FX with transparent rates, built directly into payment flows.

Full control, wherever you are

Manage accounts, monitor activity, and approve transactions in real time — directly from your mobile device.

Track transactions and balances instantly.

Cards. Coming Soon

Physical and virtual cards will soon be available, designed for secure spending, real-time control, and seamless integration with your existing accounts.

Virtual Cards

Create virtual cards for online purchases, subscriptions, or specific use cases. Virtual cards provide an additional layer of security while keeping full control over spending.

Physical Cards

Use a BEBAWA physical card for in-store and online payments, linked directly to your account balances. Designed for secure spending with real-time visibility and control.

Regulated. Secure. Reliable.

Enterprise-grade security and compliance built into every layer of the platform.

Regulatory-first infrastructure

BEBAWA is built to meet European regulatory standards, with security and compliance embedded into every process — from onboarding to payments.

Audit-ready activity logs

Strong Customer Authentication (SCA)

Role-based access & approvals

End-to-end encryption

One platform. Many use cases.

Technology that adapts to your needs and supports how you choose to operate.

From signup to active account — fast and secure.

Get Started